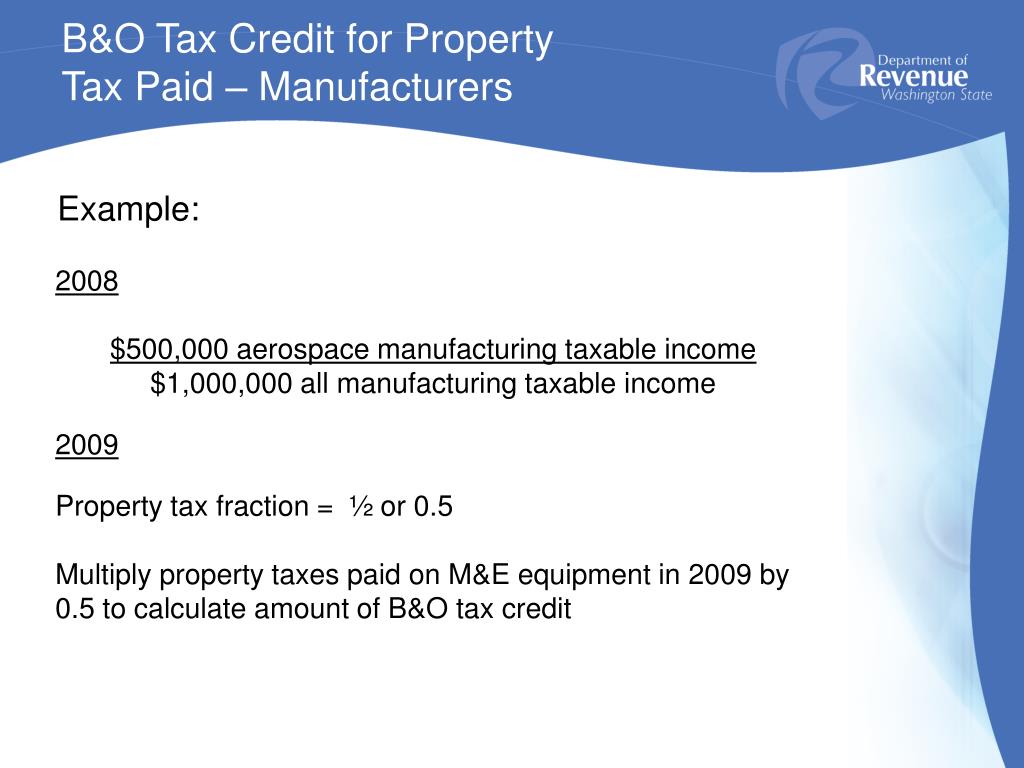

b&o tax credit

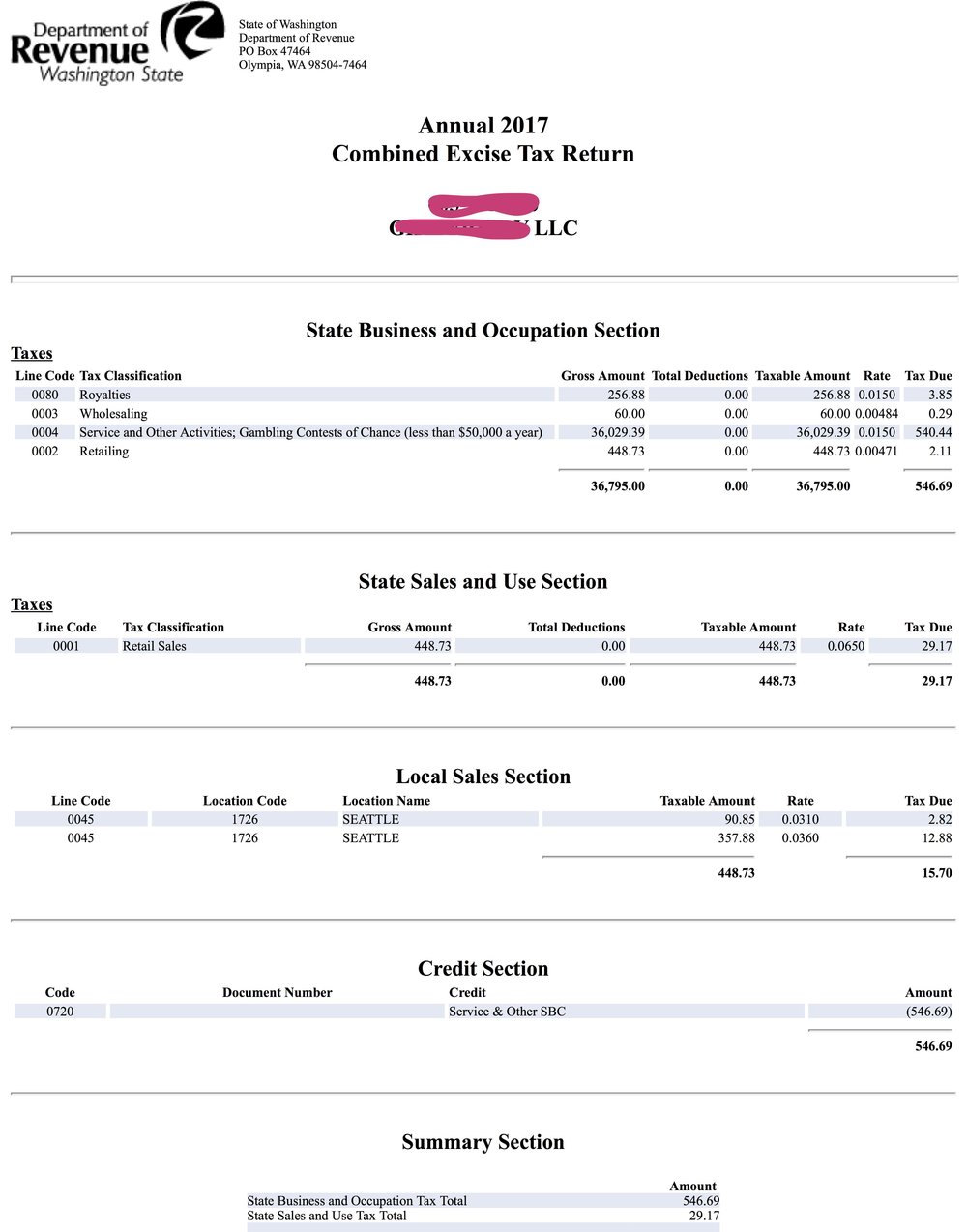

3 The tax rate depends on the classification ie manufacturing wholesaling. Add total tax due of all BO classifications on your tax return If taking additional BO tax credits a worksheet is.

Heritage Bank And Bare Boutique Keep Tax Dollars Local

To address this Washington recently issued a tax decision requiring intercompany payments to be included as gross income for BO tax purposes.

. 71 for monthly taxpayers. It was fast-tracked with a hearing. Use External Credits when one of your business activities.

Are There Credits for BO Tax. It is recommended you consult. Your BO tax liability is under.

By exempting firms with up to 125000 in gross receipts from the Business Occupations Tax BO and expanding the Small Business Tax Credit to those enterprises. An ordinance of the Council of the City of Fairmont enacted in part pursuant to the provisions of West Virginia Code Section 8-1-5a Municipal. However your business may qualify for certain exemptions deductions or credits.

Rural County B. The small business tax credit is broken up. The major BO tax credits are.

Examining a BO tax case. If youve got a service business doing less than about 56000 in annual revenues or a manufacturing or retail business doing less than about. Your 2012 IRS Deduction may be up to 1000.

211 for quarterly taxpayers. As part of a Nationally Certified Main Street Community your business can designate its Business Occupation BO or Public Utility tax PUT to be spent directly on Downtown Kennewick. Use Internal Credits when both your business activities manufacturing and retail sales for example occurred within Seattle.

Business Occupation BO Tax Credits. Unlike the retail sales tax a sale. If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent 5 of the tax for the first month or fraction.

Members of Wheeling City Council now will vote in early February on a one-time BO Tax credit program for small businesses that was approved by the citys Finance Committee. The BO tax for labor materials taxes or other costs of doing business. Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex.

The Small Business BO Tax Credit is applied on a sliding scale that depends upon the amount of tax you owe. To break this down more if your check to SDA is 1000 then your 2013 B O Tax Credit is 750. As your company becomes.

Once you have signed into your TurboTax Account for TurboTax Online sign-in. Each hospitals total available credit is capped at 1000 for each acute care available inpatient. SB 5980 Increasing small-business BO tax credit In a surprising move retiring Sen.

Hospitals can take a BO tax credit equal to 100 percent of the cost of patient lifting equipment. If you owe beneath a certain level you pay zero tax. 841 for annual taxpayers.

If youre in the manufacturing category you wont have to pay B O tax until your annual income is at about 86000 with a sliding scale after that. Small Business B. A BO tax credit may be taken thats equal to the property or leasehold excise taxes paid on new buildings land for new buildings the increased value of renovated buildings and.

Reuven Carlyle introduced SB 5980 on February 22. High Technology B. In general there are no deductions from the BO tax for labor materials or other costs of doing business.

You can include the BO tax under Other Common Business Expenses Taxes and Licenses. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. If you qualify the Department of Revenue provides.

Multiple Activities Tax Credit MATC Credit. Determine the total Business and Occupation BO tax due.

Parkersburg City Council Continues B O Tax Exemption For Local Businesses Wv News Wvnews Com

Business And Occupation B O Tax Washington State And City Of Bellingham

Buyers Retail Sales Tax Exemption Certificate Wa Fill Online Printable Fillable Blank Pdffiller

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

Ppt Washington S Aerospace Tax Incentives Powerpoint Presentation Free Download Id 5764876

Thousands Of Washington Businesses Could Get A Tax Break King5 Com

What Types Of Taxes Must I File As A Washington Based Therapist

B Amp O Tax Return City Of Bellevue

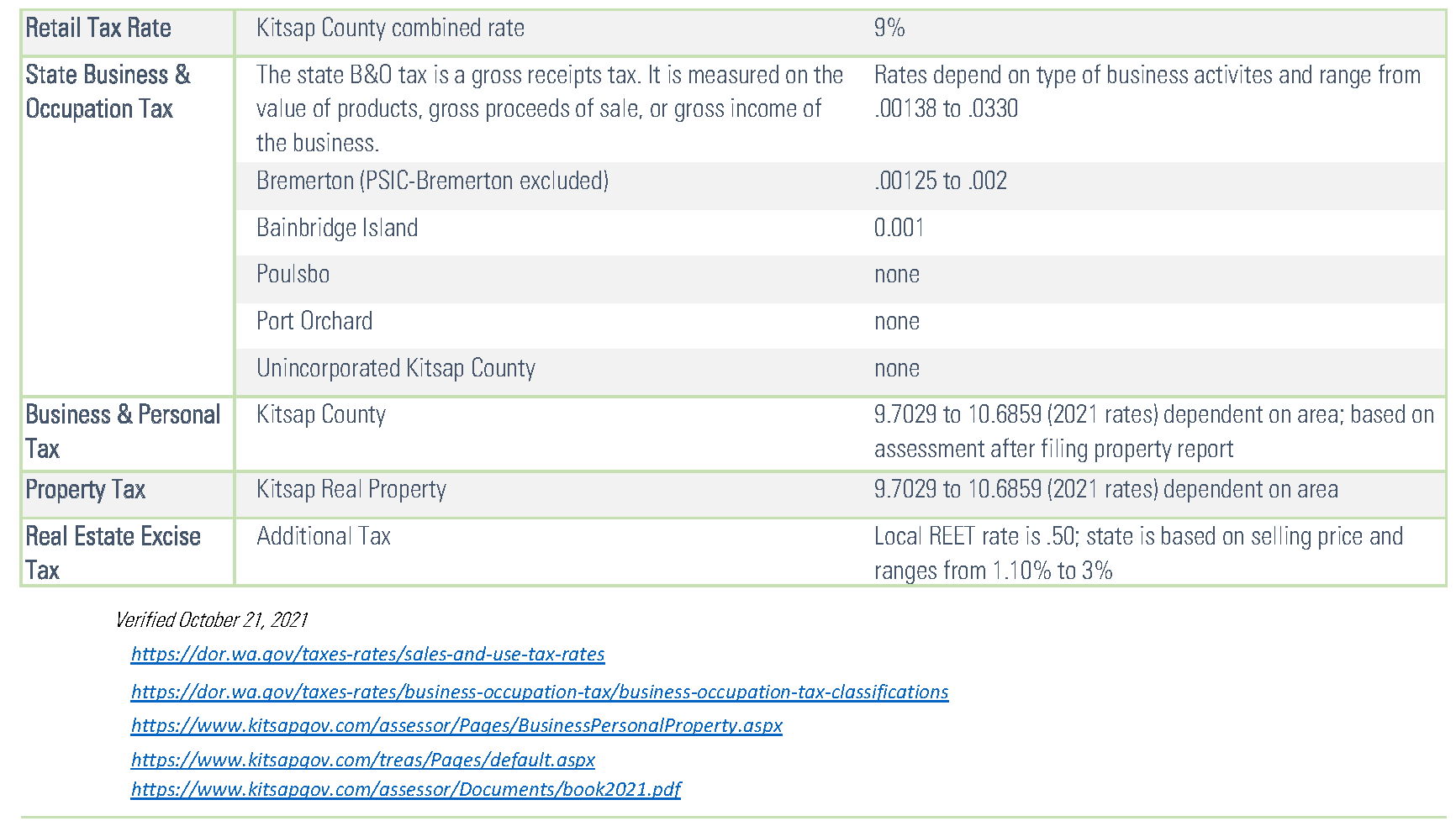

Taxes And Incentives For Kitsap County Wa

Auburn Studies First Draft Of Proposed B O Tax Auburn Reporter

Tax Credit Incentive Stevensonmainstreet

Wheeling Finance Committee Approves B O Tax Credit Lede News

Business Occupation Tax Bainbridge Island Wa Official Website

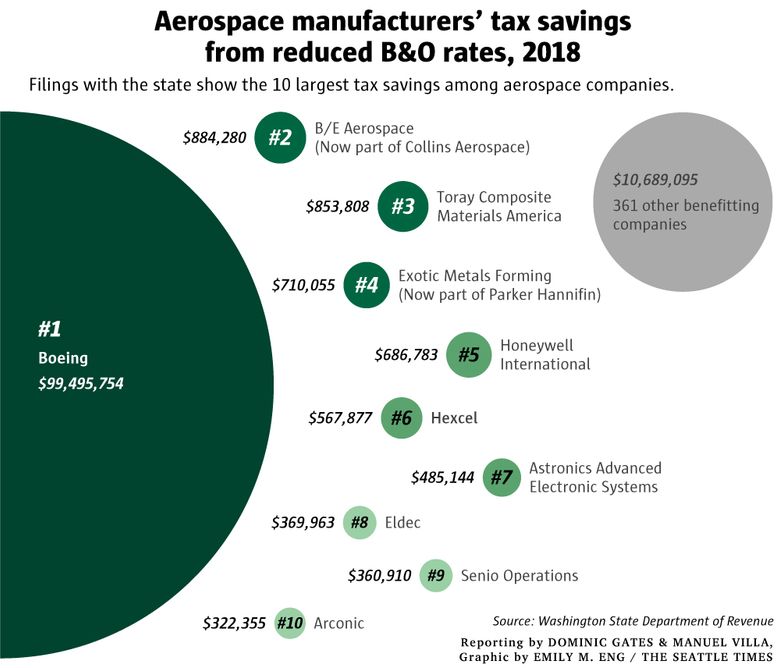

Boeing May Give Up Its Major Washington State Tax Break To Avoid European Tariffs The Seattle Times

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Washington State Tax Updates Withum

Washington State B O Tax Guidelines For Covid Relief

Allocate Your B O Tax Historic Downtown Kennewick Partnership