working in nyc living in pa taxes

100s of Top Rated Local Professionals Waiting to Help You Today. The Department of Finance DOF administers business income and excise taxes.

State Income Taxes For U S Expats Living Abroad H R Block

Working in nyc living in pa taxes Monday May 30 2022 Edit.

. If you are still receiving income from NY then yes you are still liable for NY income tax. Answer 1 of 11. Everyone is welcome we needs all kinds of skillsets and we provide you with training.

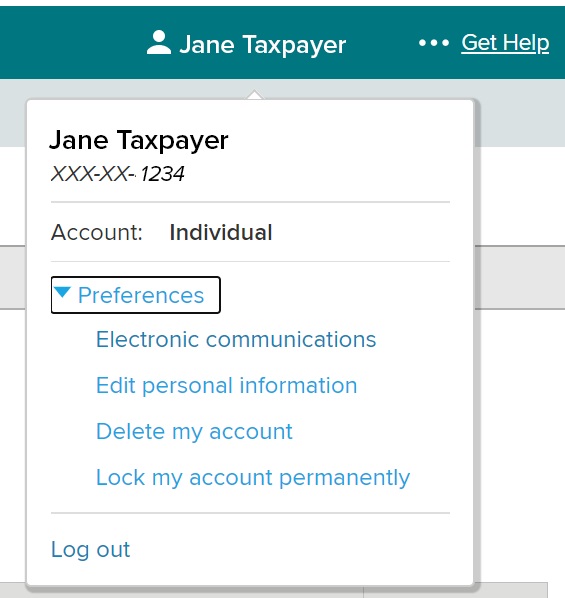

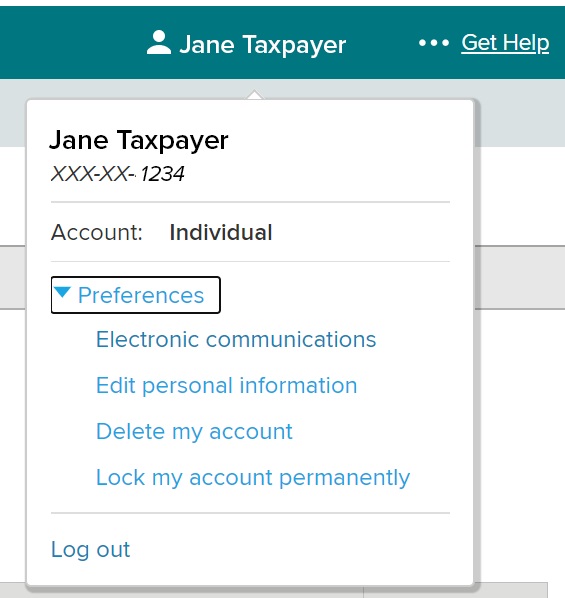

This means for example a Pennsylvania resident working in one of those states must file a return in that state pay the tax and then take a credit on his or her Pennsylvania return. NY will want you to figure the NY State income tax. Youll be taxed by NY for your NY earned income at least NYC tax doesnt apply to non-residents so itll just be NY state taxes on your wages.

Be careful about telecommuting days. For one it boasts a low cost of living and a very low-income tax. Answer 1 of 5.

Provide free tax prep assistance to those who need it most. PICPA - Pennsylvania Institute of Certified Public Accountants. Ad Become a Tax-Aide volunteer.

In short youll have to file your taxes in both states if you live in NJ and work in NY. You pay out of state income taxes to the State of NY on portion of income earned in New York imagine if. NY does have a higher.

I brought m y house in 2007 and in nys i payed for. I work in new york but live in pa. Im paying taxes in nyc but dont live therThe taxes im talking about is state and local.

I work in new york but live in pa. I know people who have been hacking this for years. Answer 1 of 11.

Your domicile is New York City. DOF also assesses the value of all New York City properties collects property taxes and other property. 2 days agoAssuming a top tax rate of 37 heres a look at how much youd take home after taxes in each state and Washington DC if you won the 19 billion jackpot for both the lump.

This form calculates the. And where in NY. Like most US States both New York and New Jersey require that you pay State income.

I understand they have really big houses in Pennsylvania. Living in PA and Working in MD Pros and Cons Pennsylvania 10 replies Tax implications of living in PA and working in NY Pennsylvania 3 replies Living in Reading. Taxes Pennsylvania 3 replies.

You pay state and federal taxes in the State of PA on total income. On your PA return theyll figure out your PA tax.

Multiple States Figuring What S Owed When You Live And Work In More Than One State Turbotax Tax Tips Videos

Stroudsburg Pa A Small Town At The Heart Of The Poconos The New York Times

Madison Square Garden Parking Reserve Now With Spothero

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Additional Information About New York State Income Tax Refunds

Pennsylvania Income Tax Calculator Smartasset

Pennsylvania Retirement Tax Friendliness Smartasset

Pennsylvania Income Tax Calculator Smartasset

I Work In Nyc But Recently Moved To Pa From Nyc And My Employer Stopped Deducting Nyc Tax Will I Have To Pay That At The End Of The Year Quora

Find Local Tax Offices Professionals Near You H R Block Reg

Nyc Mortgage Recording Tax 2022 Buyer S Guide Prevu

How Future Employment Patterns Could Put Philadelphia S Operating Budget At Risk The Pew Charitable Trusts

Remote Work And The State Tax War City Journal

If I Work In Ny But Live In Nj Do I Pay Taxes In Both States

How 1 000 A Month In Guaranteed Income Is Helping N Y C Mothers The New York Times

Reciprocal Agreements By State What Is Tax Reciprocity

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Live In Nj Work In Nyc Taxes Guide 2022 Propertyclub

Can Nyc Live Without Its 1 7 Billion A Year Developer Tax Break Dueling Claims Define Budget Talks The City