jersey city property tax calculator

Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving. General Property Tax Information.

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

11 rows City of Jersey City.

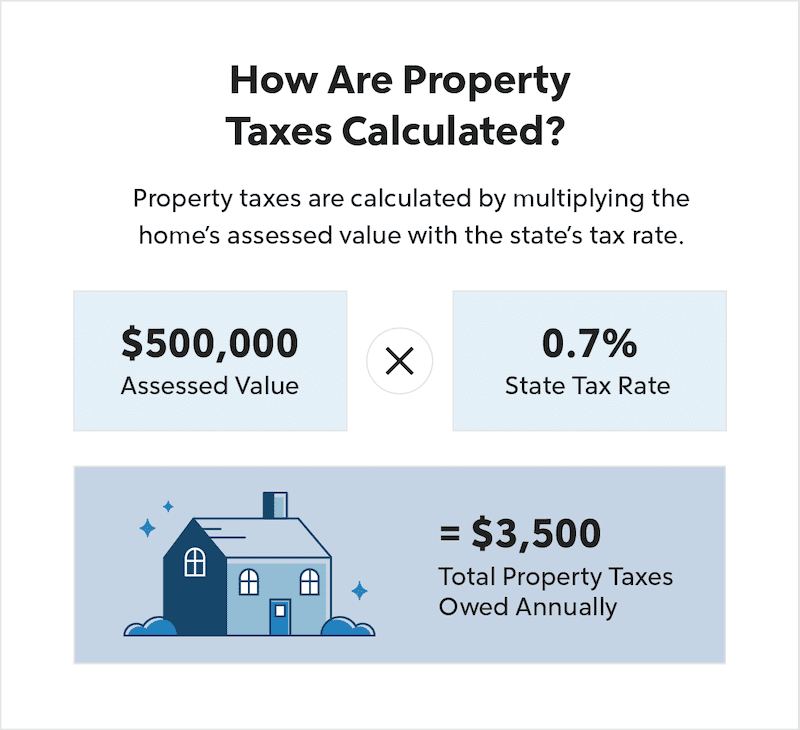

. Online Inquiry Payment. The total amount of property tax to be collected by a town is determined by its county municipal and school budget costs. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Enter Your Salary and the Jersey. Your average tax rate is 1198 and your marginal tax. Federal income taxes are also withheld from each of your paychecks.

Your employer uses the information that you provided on your W-4 form to. Office of the City Assessor. All real property is assessed according to the same standard.

Your yearly tax is calculated based on your total taxable income in the year less any deductions you can claim. Calculation of income tax. Tax amount varies by county.

New Jersey Income Tax Calculator 2021. If you make 70000 a year living in the region of New Jersey USA you will be taxed 12783. Account Number Block Lot Qualifier Property Location 18 14502 00011 20.

TO VIEW PROPERTY TAX ASSESSMENTS. There is also an exemption threshold where you dont. Ad Just Enter your Zip for Property Values By Address in Your Area.

The calculator makes standard assumptions to estimate your tax and long-term care. 189 of home value. Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Expert Results for Free. For comparison the median home value in New Jersey is.

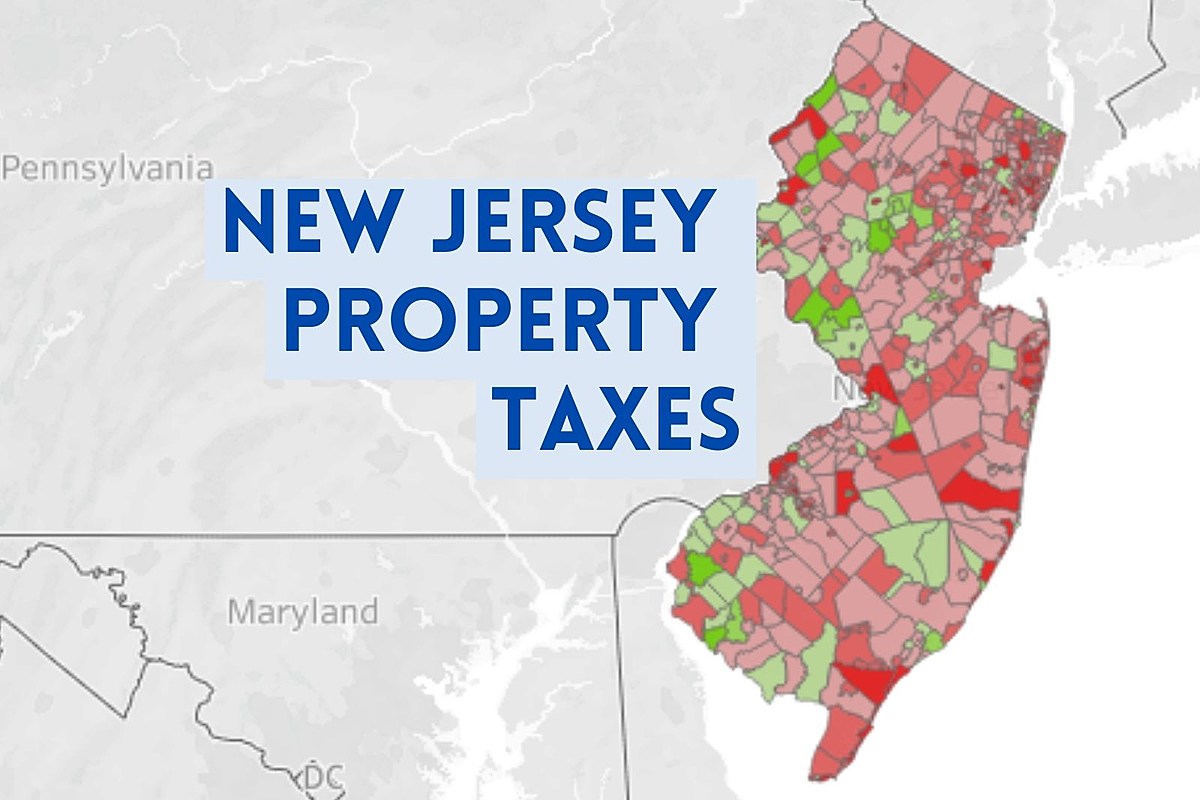

Free Comprehensive Details on Homes Property Near You. Box 2025 Jersey City NJ 07303. New Jersey has one of the highest average property tax rates in the country with only.

For comparison the median home value in Jersey County is. How Your New Jersey Paycheck Works. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. New Jerseys real property tax is an ad valorem tax or a tax according to value. Jersey City establishes tax levies all within the states statutory rules.

To view Jersey City Tax Rates and Ratios read more here. A towns general tax rate is calculated by dividing. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

For comparison the median home value in Ocean County is.

Average Nj Property Tax Bill Near 9 300 Check Your Town Here

Riverside County Ca Property Tax Calculator Smartasset

Calculating Your Property Taxes

Property Tax Definition Uses And How To Calculate Thestreet

Property Taxes By County Interactive Map Tax Foundation

How High Are Property Taxes In Your State Tax Foundation

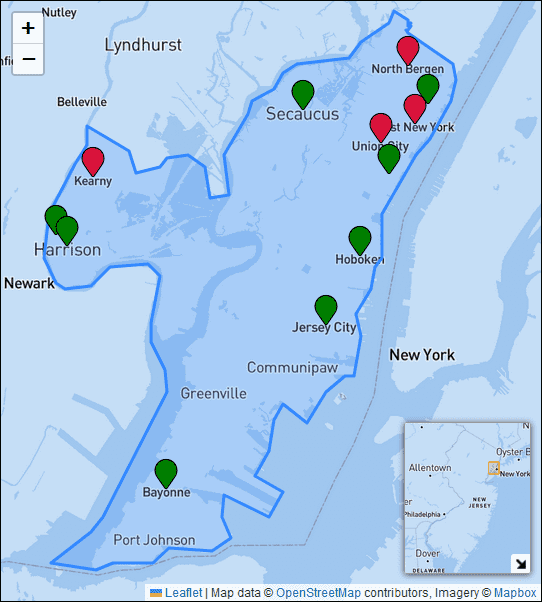

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

City Planning City Of Jersey City

Property Taxes Urban Institute

Township Of Teaneck New Jersey Tax Collector

Property Taxes City Of Jersey City

Real Estate Taxes Vs Property Taxes Quicken Loans

New Jersey Sales Tax Rate Rates Calculator Avalara

New Jersey Income Tax Calculator Smartasset

![]()

New Jersey Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Property Tax Calculator Smartasset

New Jersey Property Tax Calculator Smartasset

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey